How do you calculate callable price of a bond?

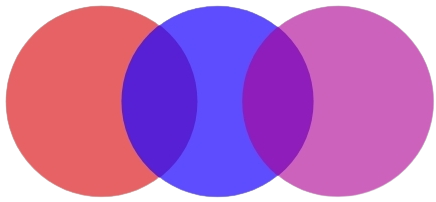

price of callable bond = price of straight bond – price of call option;

- Price of a callable bond is always lower than the price of a straight bond because the call option adds value to an issuer.

- Yield on a callable bond is higher than the yield on a straight bond.

How do you calculate bond price?

The bond price can be summarized as the sum of the present value of the par value repaid at maturity and the present value of coupon payments. The present value of coupon payments is the present value of an annuity of coupon payments. i is the number of periods and n is the per period interest rate.

How do you solve for call price?

Calculate Value of Call Option You can calculate the value of a call option and the profit by subtracting the strike price plus premium from the market price. For example, say a call stock option has a strike price of $30/share with a $1 premium, and you buy the option when the market price is also $30.

Are callable bonds cheaper?

Callable bonds can be called away by the issuer before the maturity date, making them riskier than noncallable bonds. However, callable bonds compensate investors for their higher risk by offering slightly higher interest rates.

How do you calculate until callable period?

Divide the required yield-to-call rate by the number of payments per year. For example, if you wanted a 5 percent yield-to-call rate on a callable bond, which makes coupon payments twice per year, you would divide 0.05 by 2 to get 0.025. This is the periodic yield.

What is the bond formula?

The term “bond formula” refers to the bond price determination technique that involves computation of present value (PV) of all probable future cash flows, such as coupon payments and par or face value at maturity. The PV is calculated by discounting the cash flow using yield to maturity (YTM).

How does call pricing work?

A call option gives you the right, but not the requirement, to purchase a stock at a specific price (known as the strike price) by a specific date, at the option’s expiration. For this right, the call buyer will pay an amount of money called a premium, which the call seller will receive.

Why would you buy a callable bond?

Callable bonds can be called away by the issuer before the maturity date, making them riskier than noncallable bonds. However, callable bonds compensate investors for their higher risk by offering slightly higher interest rates. Callable bonds are a good investment when interest rates remain unchanged.

Why do companies issue callable bonds?

Why Companies Issue Callable Bonds Companies issue callable bonds to allow them to take advantage of a possible drop in interest rates in the future. The issuing company can redeem callable bonds before the maturity date according to a schedule in the bond’s terms.

How do I know if a bond is callable?

A callable—redeemable—bond is typically called at a value that is slightly above the par value of the debt. The earlier in a bond’s life span that it is called, the higher its call value will be. For example, a bond maturing in 2030 can be called in 2020. It may show a callable price of 102.

How do you calculate bond interest?

To figure out the total interest paid, you take the face value of the bond, multiply it by the coupon interest rate, and then multiply that by the number of years corresponding to the term of the bond. For instance, say a company issues a five-year bond with a face value of $1,000 and a 2% interest rate.

How could a callable bond trade above its call price?

– Pay a higher coupon or interest rate – Investor-financed debt is more flexibility for the issuer – Helps companies raise capital – Call features allow recall and refinancing of debt

How do you calculate the price of a bond?

Bond Price = 92.6 + 85.7 + 79.4 + 73.5 + 68.02 + 680.58; Bond Price = Rs 1079.9; Bond Pricing Formula – Example #2. Let’s calculate the price of a Reliance corporate bond which has a par value of Rs 1000 and coupon payment is 5% and yield is 8%. The maturity of the bond is 10 years

How to find price of bond calculator?

… on its website – a 2022 Bond Election Tax Calculator and a 2022 Bond Election Tax Chart – to assist voters in calculating their annual estimated tax increase based on the current bond market value, and residents have called the assessor’s office

Are convertible bonds safer than callable bonds?

While convertible bonds have greater appreciation potential than corporate bonds, they are also more vulnerable to losses if the issuer defaults (or fails to make its interest and principal payments on time). For that reason, investors in individual convertible bonds should be sure to conduct extensive credit research.